ASSESSMENTS

Why Central Banks Could Mint Their Own Digital Currency

Mar 28, 2018 | 08:00 GMT

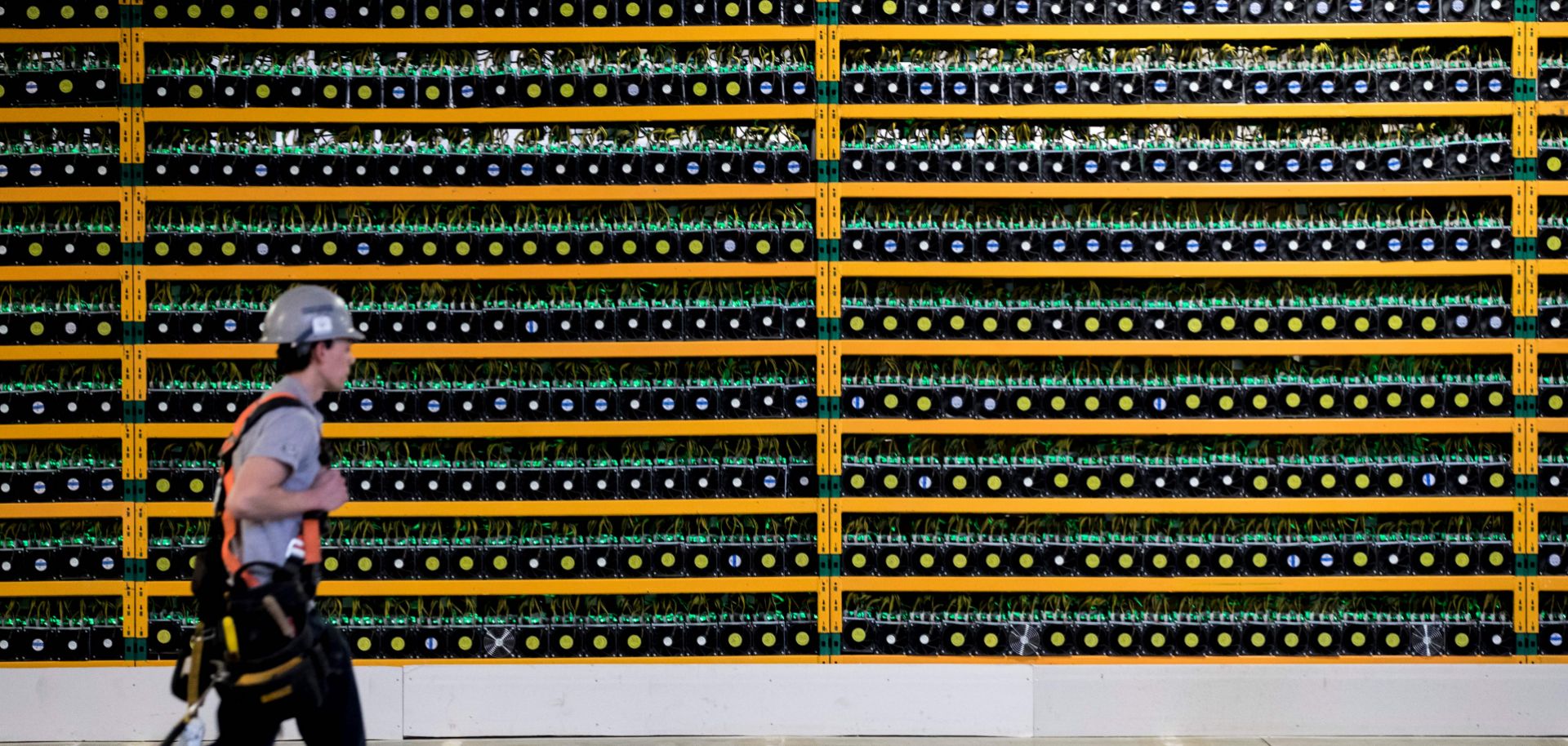

Following the boom and (partial) bust of various private cryptocurrencies over the last six months, several central banks are seriously considering introducing their own national digital currencies.

(LARS HAGBERG/AFP/Getty Images)

Highlights

- Only 8 percent of global financial transactions today involve cash, but that figure will diminish even further as digital currencies gain prominence.

- Faced with the growth of cryptocurrencies such as bitcoin, central banks around the world will continue their research into introducing their own digital currencies.

- By entering the market for cryptocurrencies, central banks could pose a profound threat to the commercial banking business model.

Subscribe Now

SubscribeAlready have an account?